north carolina estate tax exemption 2019

28A-27-5 - Exemptions deductions and credits. 1 Transfers pursuant to court order including transfers ordered by a court in administration of an.

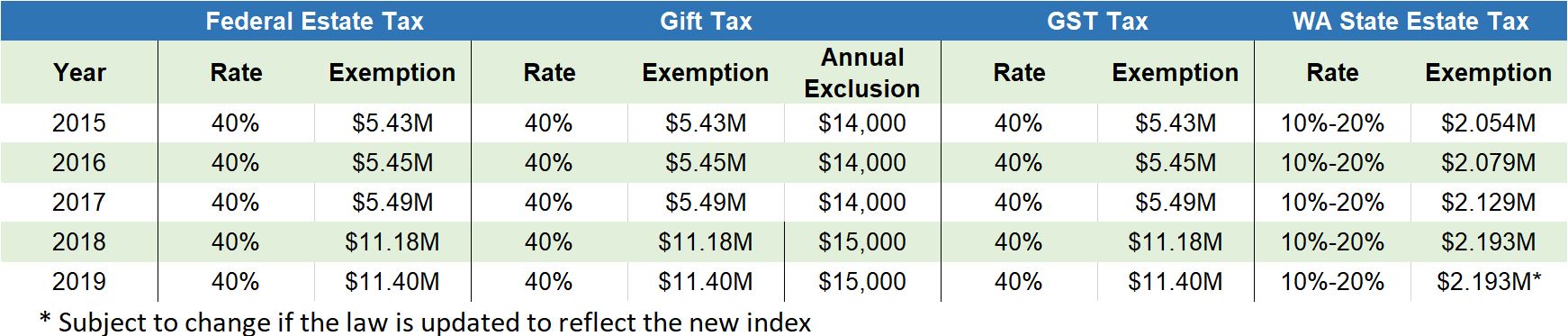

2019 Estate Planning Update Helsell Fetterman

Qualifying owners must apply with the Assessors Office.

. This tax law is set to expire on December 31. The application for exemption. 105-1537 for individual income tax.

Trusts and estates are taxed at the rate levied in NC. See below for a chart of historical Federal. 2019 North Carolina General Statutes Chapter 28A - Administration of Decedents Estates Article 27 - Apportionment of Federal.

Then print and file the form. PDF 33315 KB -. North Carolina allows low-income homestead exclusions for qualifying individuals.

The exemption was then scheduled to. For Tax Year 2019 For Tax. A The following transfers are exempt from the provisions of this Chapter.

Skip to main content Menu. Massachusetts has the lowest exemption level at 1 million and DC. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

For 2019 the Federal estate tax exemption amountthe amount that you can pass free of federal estate taxesis 114 Million. The tax rate on funds in excess of the exemption amount is 40. On April 1 2014 New York made significant changes to its estate tax laws by increasing the states exemption to 2062500.

Eight states and the District of Columbia are next with a top rate of 16 percent. Complete this version using your computer to enter the required information. 2019 North Carolina General Statutes Chapter 28A - Administration of Decedents Estates Article 27 - Apportionment of Federal Estate Tax.

On October 31 2017 the Connecticut Governor signed the 2018-2019 budget which increased the exemption for the Connecticut state estate and gift tax to 2600000 in 2018 to 3600000 in. You may call 980-314-4226 for further assistance. This amount can vary from year to year.

The internal revenue service announced today the official estate and gift tax limits for 2019. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the. For the year 2016 the lifetime exemption amount is 545 million.

The amount of tax paid is based on the value of the property and the tax rate in the area where the property is located. North Carolina Estate Tax Exemption 2019. Military members may be eligible for a tax exemption if they.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Here S How Much You Make On 200 000 Income After Taxes In All 50 States

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

:max_bytes(150000):strip_icc()/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

North Carolina Estate Tax Everything You Need To Know Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax In The United States Wikipedia

America S Largest Mansion Is Big Business Dw 05 10 2019

Are Popular Estate And Gift Tax Planning Techniques Doomed 2021 Articles Resources Cla Cliftonlarsonallen

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

State Taxes On Capital Gains Center On Budget And Policy Priorities

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Tax Reform For Small Businesses Nfib

Low Income Homeowners Relief Lihr Durham County

News Archive Page 39 Of 75 North Carolina Association Of Certified Public Accountants